Silicon Motion Demonstrates Flexible Data Placement on MonTitan Gen 5 Enterprise SSD Platform - Related to reduces, platform, act, arm, 5

Intel Sells Its Arm Shares, Reduces Stakes in Other Companies

Intel has divested its entire stake in Arm Holdings during the second quarter, raising approximately $147 million. Alongside this, Intel sold its stake in cybersecurity firm ZeroFox and reduced its holdings in Astera Labs, all as part of a broader effort to manage costs and recover cash amid significant financial challenges.

The sale of Intel's million shares in Arm Holdings. As reported in a recent SEC filing, comes at a time when the enterprise is struggling with substantial financial losses. Despite the $147 million generated from the sale, Intel reported a $120 million net loss on its equity investments for the quarter, which is a part of a larger $ billion loss that Intel faced during this period.

In addition to selling its stake in Arm, Intel also exited its investment in ZeroFox and. Reduced its involvement with Astera Labs, a organization known for developing connectivity platforms for enterprise hardware. These moves are in line with Intel's strategy to reduce costs and stabilize its financial position as it faces ongoing market challenges.

Despite the divestment. Intel's past investment in Arm was likely driven by strategic considerations. Arm Holdings is a significant force in the semiconductor industry, with its designs powering most mobile devices, and. For obvious reasons, Intel would like to address these. Intel and Arm are also collaborating on datacenter platforms tailored for Intel's 18A process technology. Additionally, Arm might view Intel as a potential licensee for its technologies and a valuable partner for other companies that license Arm's designs.

Intel's investment in Astera Labs was also a strategic one as the corporation probably wanted to secure steady supply of smart retimers, smart cable modems, and CXL memory controller. Which are used in volumes in datacenters and Intel is certainly interested in selling as many datacenter CPUs as possible.

Intel's financial struggles were highlighted earlier this month when the business released a disappointing earnings research, which led to a 33% drop in its stock value, erasing billions of dollars of capitalization. To counter these difficulties, Intel showcased plans to cut 15,000 jobs and implement other expense reductions. The business has also suspended its dividend, signaling the depth of its efforts to conserve cash and focus on recovery. When it comes to divestment of Arm stock, the need for immediate financial stabilization has presumably taken precedence, leading to the decision.

If you are currently in the market looking to buy a thin-and-light laptop chances you are just bomba...

Apple just dropped an app that’s all about creating event invites.

Today is the day before the RX 6700 officially launches, and. If you are lucky enough you might be ab...

U.S. Signs $1.5B in CHIPS Act Agreements With Amkor and SKhynix for Chip Packaging Plants

Under the CHIPS & Science Act, the government provided tens of billions of dollars in grants and loans to the world's leading maker of chips, such as Intel, Samsung. And TSMC, which will significantly expand the country's semiconductor production industry in the coming years. However, most chips are typically tested, assembled, and packaged in Asia, which has left the American supply chain incomplete. Addressing this last gap in the government's domestic chip production plans, these past couple of weeks the government signed memorandums of understanding worth about $ billion with Amkor and SK hynix to support their efforts to build chip packaging facilities in the .

Amkor to Build Advanced Packaging Facility with Apple in Mind.

Amkor plans to build a $2 billion advanced packaging facility near Peoria, Arizona. To test and assemble chips produced by TSMC at its Fab 21 near Phoenix, Arizona. The company signed a MOU that offers $400 million in direct funding and access to $200 million in loans under the CHIPS & Science Act. In addition, the company plans to take advantage of a 25% investment tax credit on eligible capital expenditures.

Set to be strategically positioned near TSMC's upcoming Fab 21 complex in Arizona, Amkor's Peoria facility will occupy 55 acres and, when fully completed. Will feature over 500,000 square feet (46,451 square meters) of cleanroom space, more than twice the size of Amkor's advanced packaging site in Vietnam. Although the organization has not disclosed the exact capacity or the specific technologies the facility will support, it is expected to cater to a wide range of industries, including automotive. High-performance computing, and mobile technologies. This points to the new plant will offer diverse packaging solutions, including traditional, , and 3D technologies.

Amkor has collaborated extensively with Apple on the vision and initial setup of the Peoria facility, as Apple is slated to be the facility's first and. Largest customer, marking a significant commitment from the tech giant. This partnership highlights the importance of the new facility in reinforcing the semiconductor supply chain and. Positioning Amkor as a key partner for companies relying on TSMC's manufacturing capabilities. The project is expected to generate around 2,000 jobs and is scheduled to begin operations in 2027.

This week SK hynix also signed a preliminary agreement with the government to receive up to $450 million in direct funding and $500 million in loans to build an advanced memory packaging facility in West Lafayette. Indiana.

The proposed facility is scheduled to begin operations in 2028, which means that it will assemble HBM4 or HBM4E memory. Meanwhile, DRAM devices for high bandwidth memory (HBM) stacks will still be produced in South Korea. Nonetheless, packing finished HBM4/HBM4E in the and possibly integrating these memory modules with high-end processors is a big deal.

In addition to building its packaging plant, SK hynix plans to collaborate with Purdue University and. Other local research institutions to advance semiconductor technology and packaging innovations. This partnership is intended to bolster research and development in the region, positioning the facility as a hub for AI technology and. Skilled employment.

Samsung had quietly launched its BM1743 enterprise QLC SSD last month with a hefty TB SKU. At ...

Furthermore, in 2022, the AI boom took the world by storm, sparking up conversations about its impact on society ...

Today we have a really cool opportunity to check out an upcoming ITX enclosure from iBUYPOWER. Who a...

Silicon Motion Demonstrates Flexible Data Placement on MonTitan Gen 5 Enterprise SSD Platform

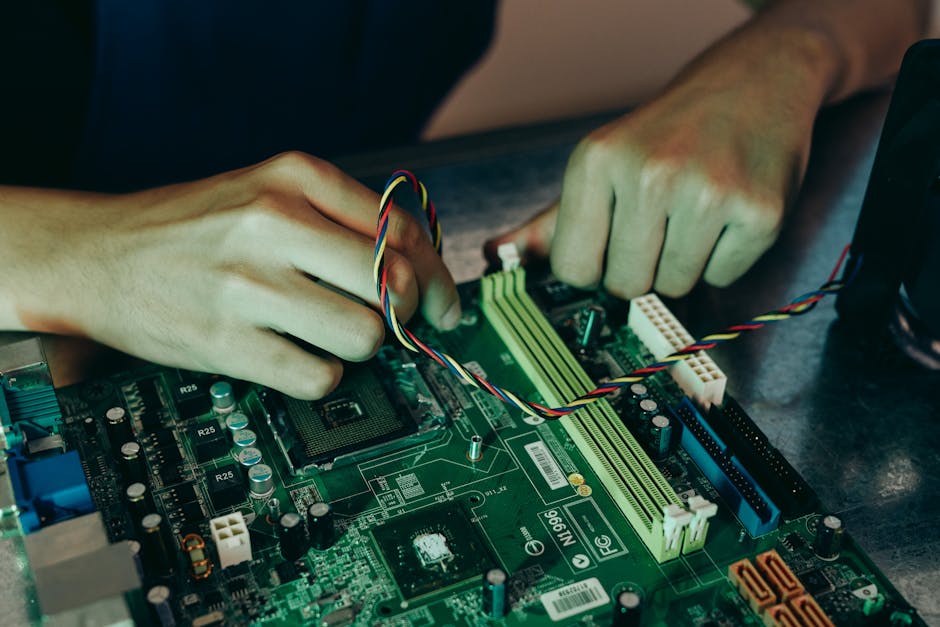

At FMS 2024, the technological requirements from the storage and memory subsystem took center stage. Both SSD and controller vendors had various demonstrations touting their suitability for different stages of the AI data pipeline - ingestion, preparation, training. Checkpointing, and inference. Vendors like Solidigm have different types of SSDs optimized for different stages of the pipeline. At the same time, controller vendors have taken advantage of one of the capabilities introduced not long ago in the NVM Express standard - Flexible Data Placement (FDP).

FDP involves the host providing information / hints about the areas where the controller could place the incoming write data in order to reduce the write amplification. These hints are generated based on specific block sizes advertised by the device. The feature is completely backwards-compatible, with non-FDP hosts working just as before with FDP-enabled SSDs, and. Vice-versa.

Silicon Motion's MonTitan Gen 5 Enterprise SSD Platform was unveiled back in 2022. Since then, Silicon Motion has been touting the flexibility of the platform. Allowing its consumers to incorporate their own attributes as part of the customization process. This approach is common in the enterprise space, as we have seen with Marvell's Bravera SC5 SSD controller in the DapuStor SSDs and Microchip's Flashtec controllers in the Longsys FORESEE enterprise SSDs.

At FMS 2024. The corporation was demonstrating the advantages of flexible data placement by allowing a single QLC SSD based on their MonTitan platform to take part in different stages of the AI data pipeline while maintaining the required quality of service (minimum bandwidth) for each process. The corporation even has a trademarked name (PerformaShape) for the firmware feature in the controller that allows the isolation of different concurrent SSD accesses (from different stages in the AI data pipeline) to guarantee this QoS. Silicon Motion indicates that this scheme will enable its clients to get the maximum write performance possible from QLC SSDs without negatively impacting the performance of other types of accesses.

Silicon Motion and. Phison have market leadership in the client SSD controller market with similar approaches. However, their enterprise SSD controller marketing couldn't be more different. While Phison has gone in for a turnkey solution with their Gen 5 SSD platform (to the extent of not adopting the white label route for this generation, and. Instead opting to get the SSDs qualified with different cloud service providers themselves), Silicon Motion is opting for a different approach. The flexibility and customization possibilities can make platforms like the MonTitan appeal to flash array vendors.

In 2022, the AI boom took the world by storm. Sparking up conversations about its impact on society ...

When you buy a retail computer CPU, it usually comes with a standard cooler. However, most enthusias...

I want to talk a little bit about CPU cooler sizes. Now we all know the typical 120mm models – like ...

Market Impact Analysis

Market Growth Trend

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| 4.9% | 5.9% | 6.2% | 6.9% | 7.3% | 7.5% | 7.6% |

Quarterly Growth Rate

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|---|

| 6.9% | 7.2% | 7.4% | 7.6% |

Market Segments and Growth Drivers

| Segment | Market Share | Growth Rate |

|---|---|---|

| Semiconductors | 35% | 9.3% |

| Consumer Electronics | 29% | 6.2% |

| Enterprise Hardware | 22% | 5.8% |

| Networking Equipment | 9% | 7.9% |

| Other Hardware | 5% | 5.3% |

Technology Maturity Curve

Different technologies within the ecosystem are at varying stages of maturity:

Competitive Landscape Analysis

| Company | Market Share |

|---|---|

| Apple | 18.7% |

| Samsung | 16.4% |

| Intel | 12.9% |

| NVIDIA | 9.8% |

| AMD | 7.3% |

Future Outlook and Predictions

The Intel Sells Shares landscape is evolving rapidly, driven by technological advancements, changing threat vectors, and shifting business requirements. Based on current trends and expert analyses, we can anticipate several significant developments across different time horizons:

Year-by-Year Technology Evolution

Based on current trajectory and expert analyses, we can project the following development timeline:

Technology Maturity Curve

Different technologies within the ecosystem are at varying stages of maturity, influencing adoption timelines and investment priorities:

Innovation Trigger

- Generative AI for specialized domains

- Blockchain for supply chain verification

Peak of Inflated Expectations

- Digital twins for business processes

- Quantum-resistant cryptography

Trough of Disillusionment

- Consumer AR/VR applications

- General-purpose blockchain

Slope of Enlightenment

- AI-driven analytics

- Edge computing

Plateau of Productivity

- Cloud infrastructure

- Mobile applications

Technology Evolution Timeline

- Technology adoption accelerating across industries

- digital transformation initiatives becoming mainstream

- Significant transformation of business processes through advanced technologies

- new digital business models emerging

- Fundamental shifts in how technology integrates with business and society

- emergence of new technology paradigms

Expert Perspectives

Leading experts in the hardware tech sector provide diverse perspectives on how the landscape will evolve over the coming years:

"Technology transformation will continue to accelerate, creating both challenges and opportunities."

— Industry Expert

"Organizations must balance innovation with practical implementation to achieve meaningful results."

— Technology Analyst

"The most successful adopters will focus on business outcomes rather than technology for its own sake."

— Research Director

Areas of Expert Consensus

- Acceleration of Innovation: The pace of technological evolution will continue to increase

- Practical Integration: Focus will shift from proof-of-concept to operational deployment

- Human-Technology Partnership: Most effective implementations will optimize human-machine collaboration

- Regulatory Influence: Regulatory frameworks will increasingly shape technology development

Short-Term Outlook (1-2 Years)

In the immediate future, organizations will focus on implementing and optimizing currently available technologies to address pressing hardware tech challenges:

- Technology adoption accelerating across industries

- digital transformation initiatives becoming mainstream

These developments will be characterized by incremental improvements to existing frameworks rather than revolutionary changes, with emphasis on practical deployment and measurable outcomes.

Mid-Term Outlook (3-5 Years)

As technologies mature and organizations adapt, more substantial transformations will emerge in how security is approached and implemented:

- Significant transformation of business processes through advanced technologies

- new digital business models emerging

This period will see significant changes in security architecture and operational models, with increasing automation and integration between previously siloed security functions. Organizations will shift from reactive to proactive security postures.

Long-Term Outlook (5+ Years)

Looking further ahead, more fundamental shifts will reshape how cybersecurity is conceptualized and implemented across digital ecosystems:

- Fundamental shifts in how technology integrates with business and society

- emergence of new technology paradigms

These long-term developments will likely require significant technical breakthroughs, new regulatory frameworks, and evolution in how organizations approach security as a fundamental business function rather than a technical discipline.

Key Risk Factors and Uncertainties

Several critical factors could significantly impact the trajectory of hardware tech evolution:

Organizations should monitor these factors closely and develop contingency strategies to mitigate potential negative impacts on technology implementation timelines.

Alternative Future Scenarios

The evolution of technology can follow different paths depending on various factors including regulatory developments, investment trends, technological breakthroughs, and market adoption. We analyze three potential scenarios:

Optimistic Scenario

Rapid adoption of advanced technologies with significant business impact

Key Drivers: Supportive regulatory environment, significant research breakthroughs, strong market incentives, and rapid user adoption.

Probability: 25-30%

Base Case Scenario

Measured implementation with incremental improvements

Key Drivers: Balanced regulatory approach, steady technological progress, and selective implementation based on clear ROI.

Probability: 50-60%

Conservative Scenario

Technical and organizational barriers limiting effective adoption

Key Drivers: Restrictive regulations, technical limitations, implementation challenges, and risk-averse organizational cultures.

Probability: 15-20%

Scenario Comparison Matrix

| Factor | Optimistic | Base Case | Conservative |

|---|---|---|---|

| Implementation Timeline | Accelerated | Steady | Delayed |

| Market Adoption | Widespread | Selective | Limited |

| Technology Evolution | Rapid | Progressive | Incremental |

| Regulatory Environment | Supportive | Balanced | Restrictive |

| Business Impact | Transformative | Significant | Modest |

Transformational Impact

Technology becoming increasingly embedded in all aspects of business operations. This evolution will necessitate significant changes in organizational structures, talent development, and strategic planning processes.

The convergence of multiple technological trends—including artificial intelligence, quantum computing, and ubiquitous connectivity—will create both unprecedented security challenges and innovative defensive capabilities.

Implementation Challenges

Technical complexity and organizational readiness remain key challenges. Organizations will need to develop comprehensive change management strategies to successfully navigate these transitions.

Regulatory uncertainty, particularly around emerging technologies like AI in security applications, will require flexible security architectures that can adapt to evolving compliance requirements.

Key Innovations to Watch

Artificial intelligence, distributed systems, and automation technologies leading innovation. Organizations should monitor these developments closely to maintain competitive advantages and effective security postures.

Strategic investments in research partnerships, technology pilots, and talent development will position forward-thinking organizations to leverage these innovations early in their development cycle.

Technical Glossary

Key technical terms and definitions to help understand the technologies discussed in this article.

Understanding the following technical concepts is essential for grasping the full implications of the security threats and defensive measures discussed in this article. These definitions provide context for both technical and non-technical readers.

CPU intermediate

RAM intermediate

platform intermediate

API beginner

How APIs enable communication between different software systems

How APIs enable communication between different software systems