DapuStor and Memblaze Target Global Expansion with State-of-the-Art Enterprise SSDs - Related to target, global, state-of-the-art, cxl, dapustor

CXL Gathers Momentum at FMS 2024

The CXL consortium has had a regular presence at FMS (which rechristened itself from 'Flash Memory Summit' to the 'Future of Memory and. Storage' this year). Back at FMS 2022, the organization had unveiled of the CXL specifications. This was followed by CXL 's introduction at Supercomputing 2023. Having started off as a host to device interconnect standard, it had slowly subsumed other competing standards such as OpenCAPI and Gen-Z. As a result, the specifications started to encompass a wide variety of use-cases by building a protocol on top of the the ubiquitous PCIe expansion bus. The CXL consortium comprises of heavyweights such as AMD and Intel, as well as a large number of startup companies attempting to play in different segments on the device side. At FMS 2024, CXL had a prime position in the booth demos of many vendors.

The migration of server platforms from DDR4 to DDR5, along with the rise of workloads demanding large RAM capacity (but not particularly sensitive to either memory bandwidth or latency). Has opened up memory expansion modules as one of the first set of widely available CXL devices. Over the last couple of years, we have had product announcements from Samsung and Micron in this area.

SK hynix CMM-DDR5 CXL Memory Module and HMSDK.

At FMS 2024. SK hynix was showing off their DDR5-based CMM-DDR5 CXL memory module with a 128 GB capacity. The business was also detailing their associated Heterogeneous Memory Software Development Kit (HMSDK) - a set of libraries and tools at both the kernel and. User levels aimed at increasing the ease of use of CXL memory. This is achieved in part by considering the memory pyramid / hierarchy and relocating the data between the server's main memory (DRAM) and. The CXL device based on usage frequency.

The CMM-DDR5 CXL memory module comes in the SDFF form-factor ( 2T) with a PCIe x8 host interface. The internal memory is based on 1α technology DRAM, and the device promises DDR5-class bandwidth and latency within a single NUMA hop. As these memory modules are meant to be used in datacenters and enterprises, the firmware includes elements for RAS (reliability, availability, and serviceability) along with secure boot and other management elements.

SK hynix was also demonstrating Niagara - a hardware solution (currently based on FPGAs) to enable memory pooling and sharing - . Connecting multiple CXL memories to allow different hosts (CPUs and GPUs) to optimally share their capacity. The previous version only allowed capacity sharing, but the latest version enables sharing of data also. SK hynix had presented these solutions at the CXL DevCon 2024 earlier this year, but some progress seems to have been made in finalizing the specifications of the CMM-DDR5 at FMS 2024.

Microchip and. Micron Demonstrate CZ120 CXL Memory Expansion Module.

Micron had unveiled the CZ120 CXL Memory Expansion Module last year based on the Microchip SMC 2000 series CXL memory controller. At FMS 2024, Micron and Microchip had a demonstration of the module on a Granite Rapids server.

Additional insights into the SMC 2000 controller were also provided.

The CXL memory controller also incorporates DRAM die failure handling, and. Microchip also provides diagnostics and debug tools to analyze failed modules. The memory controller also supports ECC, which forms part of the enterprise class RAS feature set of the SMC 2000 series. Its flexibility ensures that SMC 2000-based CXL memory modules using DDR4 can complement the main DDR5 DRAM in servers that support only the latter.

Marvell Announces Structera CXL Product Line.

A few days prior to the start of FMS 2024. Marvell had introduced a new CXL product line under the Structera tag. At FMS 2024, we had a chance to discuss this new line with Marvell and gather some additional insights.

Unlike other CXL device solutions focusing on memory pooling and expansion. The Structera product line also incorporates a compute accelerator part in addition to a memory-expansion controller. All of these are built on TSMC's 5nm technology.

The compute accelerator part, the Structera A 2504 (A for Accelerator) is a PCIe x16 CXL device with 16 integrated Arm Neoverse V2 (Demeter) cores at GHz. It incorporates four DDR5-6400 channels with support for up to two DIMMs per channel along with in-line compression and decompression. The integration of powerful server-class ARM CPU cores means that the CXL memory expansion part scales the memory bandwidth available per core. While also scaling the compute capabilities.

Applications such as Deep-Learning Recommendation Models (DLRM) can benefit from the compute capability available in the CXL device. The scaling in the bandwidth availability is also accompanied by reduced energy consumption for the workload. The approach also contributed towards disaggregation within the server for a superior thermal design as a whole.

The Structera X 2404 (X for eXpander) will be available either as a PCIe (single x16 or two x8) device with four DDR4-3200 channels (up to 3 DIMMs per channel). capabilities such as in-line (de)compression, encryption / decryption, and secure boot with hardware support are present in the Structera X 2404 as well. Compared to the 100 W TDP of the Structera X 2404, Marvell expects this part to consume around 30 W. The primary purpose of this part is to enable hyperscalers to recycle DDR4 DIMMs (up to 6 TB per expander) while increasing server memory capacity.

Marvell also has a Structera X 2504 part that supports four DDR5-6400 channels (with two DIMMs per channel for up to 4 TB per expander). Other aspects remain the same as that of the DDR4-recycling part.

The business stressed upon some unique aspects of the Structera product line - the inline compression optimizes available DRAM capacity, and. The 3 DIMMs per channel support for the DDR4 expander maximizes the amount of DRAM per expander (compared to competing solutions). The 5nm process lowers the power consumption, and the parts support accesses from multiple hosts. The integration of Arm Neoverse V2 cores appears to be a first for a CXL accelerator, and enables delegation of compute tasks to improve overall performance of the system.

While Marvell presented specifications for the Structera parts. It does appear that sampling is at least a few quarters away. One of the interesting aspects about Marvell's roadmaps / announcements in recent years has been their focus on creating products tuned to the demands of high-volume clients. The Structera product line is no different - hyperscalers are hungry to recycle their DDR4 memory modules and apparently can't wait to get their hands on the expander parts.

CXL is just starting its slow ramp-up, and. The hockey stick segment of the growth curve is definitely definitely not in the near term. However, as more host systems with CXL support start to get deployed, products like the Structera accelerator line start to make sense from a server efficiency viewpoint.

Cougar, established in 2008, has become a notable name in the PC hardware market. Particularly among...

Qualcomm this morning is taking the wraps off of a new smartphone SoC for the mid-range market, the ...

When you buy a retail computer CPU, it usually comes with a standard cooler. However, most enthusias...

DapuStor and Memblaze Target Global Expansion with State-of-the-Art Enterprise SSDs

The growth in the enterprise SSD (eSSD) market has outpaced that of the client SSD market over the last few years. The requirements of AI servers for both training and inference has been the major impetus in this front. In addition to the usual vendors like Samsung, Solidigm, Micron, Kioxia, and Western Digital serving the cloud service providers (CSPs) and the likes of Facebook, a number of companies have been at work inside China to service the burgeoning eSSD market within.

In our coverage of the Microchip Flashtec 5016. We had noted Longsys's use of Microchip's SSD controllers to prepare and market enterprise SSDs under the FORESEE brand. Long before that, two companies - DapuStor and Memblaze - started releasing eSSDs specifically focusing on the Chinese market.

There are two drivers for the current growth spurt in the eSSD market. On the performance side, usage of eTLC behind a Gen 5 controller is allowing vendors to advertise significant benefits over the Gen 4 drives in the previous generation. At the same time, a capacity play is happening where there is a race to cram as much NAND as possible into a single / EDSFF enclosure. QLC is being used for this purpose, and we saw a number of such 128 TB-class eSSDs on display at FMS 2024.

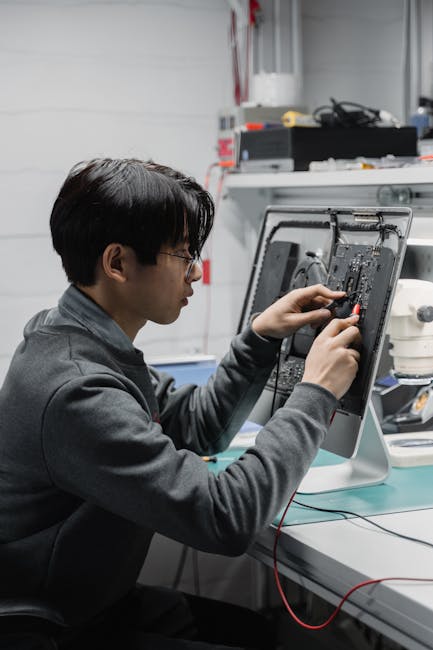

DapuStor and. Memblaze have both been relying on SSD controllers from Marvell for their flagship drives. Their latest product iterations for the Gen 5 era use the Marvell Bravera SC5 controller. Similar to the Flashtec controllers, these are not meant to be turnkey solutions. Rather, the SSD vendor has considerable flexibility in implementing specific aspects for their desired target market.

At FMS 2024, both DapuStor and. Memblaze were displaying their latest solutions for the Gen 5 market. Memblaze was celebrating the sale of 150K+ units of their flagship Gen 5 solution - the PBlaze7 7940 incorporating Micron's 232L 3D eTLC with Marvell's Bravera SC5 controller. This SSD (available in capacities up to TB) boasts of 14 GBps reads / 10 GBps writes along with random read / write performance of M / 720K - all with a typical power consumption south of 16 W. Additionally, the support for some of NVMe elements such as software-enabled flash (SEF) and zoned name space (ZNS) had helped Memblaze and. Marvell to receive a 'Best of Show' award under the 'Most Innovative Customer Implementation' category.

DapuStor had their current lineup on display (including the Haishen H5000 series with the same Bravera SC5 controller). Additionally, the firm had an unannounced proof-of-concept TB QLC SSD on display. Despite the label carrying the Haishen5 series tag (its current members all use eTLC NAND), this sample comes with QLC flash.

DapuStor has already invested resources into implementing the flexible data placement (FDP) NVMe feature into the firmware of this QLC SSD. The organization also had an interesting presentation session dealing with usage of CXL memory expansion to store the FTL for high-capacity enterprise SSDs - though this is something for the future and not related to any current product in the market.

Having established themselves within the Chinese market. Both DapuStor and Memblaze are looking to expand in other markets. Having products with leading performance numbers and capabilities in the eSSD growth segment will stand them in good stead in this endeavor.

Meta makes its Frontier AI Framework available to all.

Moving to another aspect, the corporation says it is concerned about AI-ind...

We've been reporting on camera rumors for many years and trust us. In 2025 there are few true tech s...

Samsung had quietly launched its BM1743 enterprise QLC SSD last month with a hefty TB SKU. At ...

Phison Enterprise SSDs at FMS 2024: Pascari Branding and Accelerating AI

At FMS 2024, Phison devoted significant booth space to their enterprise / datacenter SSD and PCIe retimer solutions, in addition to their consumer products. As a controller / silicon vendor, Phison had historically been working with drive partners to bring their solutions to the market. On the enterprise side, their tie-up with Seagate for the X1 series (and the subsequent Nytro-branded enterprise SSDs) is quite well-known. Seagate supplied the requirements list and had a say in the final firmware before qualifying the drives themselves for their datacenter clients. Such qualification involves a significant resource investment that is possible only by large companies (ruling out most of the tier-two consumer SSD vendors).

Phison had demonstrated the Gen 5 X2 platform at last year's FMS as a continuation of the X1. However, with Seagate focusing on its HAMR ramp, and also fighting other battles. Phison decided to go ahead with the qualification process for the X2 process themselves. In the bigger scheme of things, Phison also realized that the white-labeling approach to enterprise SSDs was not going to work out in the long run. As a result, the Pascari brand was born (ostensibly to make Phison's enterprise SSDs more accessible to end consumers).

Under the Pascari brand. Phison has different lineups targeting different use-cases: from high-performance enterprise drives in the X series to boot drives in the B series. The AI series comes in variants supporting up to 100 DWPD (more on that in the aiDAPTIVE+ subsection below).

The D200V Gen 5 took pole position in the displayed drives. Thanks to its leading TB capacity point (a TB drive is also being planned under the same line). The use of QLC in this capacity-focused line brings down the sustained sequential write speeds to GBps, but these are meant for read-heavy workloads.

The X200. On the other hand, is a Gen 5 eTLC drive boasting up to GBps sequential writes. It comes in read-centric (1 DWPD) and mixed workload variants (3 DWPD) in capacities up to TB. The X100 eTLC drive is an evolution of the X1 / Seagate Nytro 5050 platform, albeit with newer NAND and larger capacities.

These drives come with all the usual enterprise attributes including power-loss protection. And FIPS certifiability. Though Phison didn't advertise this specifically, newer NVMe attributes like flexible data placement should become part of the firmware attributes in the future.

100 GBps with Dual HighPoint Rocket 1608 Cards and Phison E26 SSDs.

Though not strictly an enterprise demo. Phison did have a station showing 100 GBps+ sequential reads and writes using a normal desktop workstation. The trick was installing two HighPoint Rocket 1608A add-in cards (each with eight slots) and placing the 16 drives in a RAID 0 configuration.

HighPoint Technology and Phison have been working together to qualify E26-based drives for this use-case. And we will be seeing more on this in a later review.

One of the more interesting demonstrations in Phison's booth was the aiDAPTIV+ Pro suite. At last year's FMS, Phison had demonstrated a 40 DWPD SSD for use with Chia (thankfully, that fad has faded). The organization has been working on the extreme endurance aspect and moved it up to 60 DWPD (which is standard for the SLC-based cache drives from Micron and Solidigm).

At FMS 2024. The enterprise took this SSD and added a middleware layer on top to ensure that workloads remain more sequential in nature. This drives up the endurance rating to 100 DWPD. Now, this middleware layer is actually part of their AI training suite targeting small business and medium enterprises who do not have the budget for a full-fledged DGX workstation, or for on-premises fine-tuning.

Re-training models by using these AI SSDs as an extension of the GPU VRAM can deliver significant TCO benefits for these companies. As the costly AI training-specific GPUs can be replaced with a set of relatively low-cost off-the-shelf RTX GPUs. This middleware comes with licensing aspects that are essentially tied to the purchase of the AI-series SSDs (that come with Gen 4 x4 interfaces currently in either or form-factors). The use of SSDs as a caching layer can enable fine-tuning of models with a very large number of parameters using a minimal number of GPUs (not having to use them primarily for their HBM capacity).

Let’s say that you get the majority of your work done on a laptop, and you are looking for some cool...

Under the CHIPS & Science Act. The government provided tens of billions of dollars in grants an...

Building on these developments, this review actually hits a little bit close to my heart, and I need to explain a little bit about t...

Market Impact Analysis

Market Growth Trend

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| 4.9% | 5.9% | 6.2% | 6.9% | 7.3% | 7.5% | 7.6% |

Quarterly Growth Rate

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|---|

| 6.9% | 7.2% | 7.4% | 7.6% |

Market Segments and Growth Drivers

| Segment | Market Share | Growth Rate |

|---|---|---|

| Semiconductors | 35% | 9.3% |

| Consumer Electronics | 29% | 6.2% |

| Enterprise Hardware | 22% | 5.8% |

| Networking Equipment | 9% | 7.9% |

| Other Hardware | 5% | 5.3% |

Technology Maturity Curve

Different technologies within the ecosystem are at varying stages of maturity:

Competitive Landscape Analysis

| Company | Market Share |

|---|---|

| Apple | 18.7% |

| Samsung | 16.4% |

| Intel | 12.9% |

| NVIDIA | 9.8% |

| AMD | 7.3% |

Future Outlook and Predictions

The 2024 Enterprise Ssds landscape is evolving rapidly, driven by technological advancements, changing threat vectors, and shifting business requirements. Based on current trends and expert analyses, we can anticipate several significant developments across different time horizons:

Year-by-Year Technology Evolution

Based on current trajectory and expert analyses, we can project the following development timeline:

Technology Maturity Curve

Different technologies within the ecosystem are at varying stages of maturity, influencing adoption timelines and investment priorities:

Innovation Trigger

- Generative AI for specialized domains

- Blockchain for supply chain verification

Peak of Inflated Expectations

- Digital twins for business processes

- Quantum-resistant cryptography

Trough of Disillusionment

- Consumer AR/VR applications

- General-purpose blockchain

Slope of Enlightenment

- AI-driven analytics

- Edge computing

Plateau of Productivity

- Cloud infrastructure

- Mobile applications

Technology Evolution Timeline

- Technology adoption accelerating across industries

- digital transformation initiatives becoming mainstream

- Significant transformation of business processes through advanced technologies

- new digital business models emerging

- Fundamental shifts in how technology integrates with business and society

- emergence of new technology paradigms

Expert Perspectives

Leading experts in the hardware tech sector provide diverse perspectives on how the landscape will evolve over the coming years:

"Technology transformation will continue to accelerate, creating both challenges and opportunities."

— Industry Expert

"Organizations must balance innovation with practical implementation to achieve meaningful results."

— Technology Analyst

"The most successful adopters will focus on business outcomes rather than technology for its own sake."

— Research Director

Areas of Expert Consensus

- Acceleration of Innovation: The pace of technological evolution will continue to increase

- Practical Integration: Focus will shift from proof-of-concept to operational deployment

- Human-Technology Partnership: Most effective implementations will optimize human-machine collaboration

- Regulatory Influence: Regulatory frameworks will increasingly shape technology development

Short-Term Outlook (1-2 Years)

In the immediate future, organizations will focus on implementing and optimizing currently available technologies to address pressing hardware tech challenges:

- Technology adoption accelerating across industries

- digital transformation initiatives becoming mainstream

These developments will be characterized by incremental improvements to existing frameworks rather than revolutionary changes, with emphasis on practical deployment and measurable outcomes.

Mid-Term Outlook (3-5 Years)

As technologies mature and organizations adapt, more substantial transformations will emerge in how security is approached and implemented:

- Significant transformation of business processes through advanced technologies

- new digital business models emerging

This period will see significant changes in security architecture and operational models, with increasing automation and integration between previously siloed security functions. Organizations will shift from reactive to proactive security postures.

Long-Term Outlook (5+ Years)

Looking further ahead, more fundamental shifts will reshape how cybersecurity is conceptualized and implemented across digital ecosystems:

- Fundamental shifts in how technology integrates with business and society

- emergence of new technology paradigms

These long-term developments will likely require significant technical breakthroughs, new regulatory frameworks, and evolution in how organizations approach security as a fundamental business function rather than a technical discipline.

Key Risk Factors and Uncertainties

Several critical factors could significantly impact the trajectory of hardware tech evolution:

Organizations should monitor these factors closely and develop contingency strategies to mitigate potential negative impacts on technology implementation timelines.

Alternative Future Scenarios

The evolution of technology can follow different paths depending on various factors including regulatory developments, investment trends, technological breakthroughs, and market adoption. We analyze three potential scenarios:

Optimistic Scenario

Rapid adoption of advanced technologies with significant business impact

Key Drivers: Supportive regulatory environment, significant research breakthroughs, strong market incentives, and rapid user adoption.

Probability: 25-30%

Base Case Scenario

Measured implementation with incremental improvements

Key Drivers: Balanced regulatory approach, steady technological progress, and selective implementation based on clear ROI.

Probability: 50-60%

Conservative Scenario

Technical and organizational barriers limiting effective adoption

Key Drivers: Restrictive regulations, technical limitations, implementation challenges, and risk-averse organizational cultures.

Probability: 15-20%

Scenario Comparison Matrix

| Factor | Optimistic | Base Case | Conservative |

|---|---|---|---|

| Implementation Timeline | Accelerated | Steady | Delayed |

| Market Adoption | Widespread | Selective | Limited |

| Technology Evolution | Rapid | Progressive | Incremental |

| Regulatory Environment | Supportive | Balanced | Restrictive |

| Business Impact | Transformative | Significant | Modest |

Transformational Impact

Technology becoming increasingly embedded in all aspects of business operations. This evolution will necessitate significant changes in organizational structures, talent development, and strategic planning processes.

The convergence of multiple technological trends—including artificial intelligence, quantum computing, and ubiquitous connectivity—will create both unprecedented security challenges and innovative defensive capabilities.

Implementation Challenges

Technical complexity and organizational readiness remain key challenges. Organizations will need to develop comprehensive change management strategies to successfully navigate these transitions.

Regulatory uncertainty, particularly around emerging technologies like AI in security applications, will require flexible security architectures that can adapt to evolving compliance requirements.

Key Innovations to Watch

Artificial intelligence, distributed systems, and automation technologies leading innovation. Organizations should monitor these developments closely to maintain competitive advantages and effective security postures.

Strategic investments in research partnerships, technology pilots, and talent development will position forward-thinking organizations to leverage these innovations early in their development cycle.

Technical Glossary

Key technical terms and definitions to help understand the technologies discussed in this article.

Understanding the following technical concepts is essential for grasping the full implications of the security threats and defensive measures discussed in this article. These definitions provide context for both technical and non-technical readers.

PCIe intermediate

CPU intermediate

middleware intermediate

RAM intermediate

encryption intermediate

Basic encryption process showing plaintext conversion to ciphertext via encryption key

Basic encryption process showing plaintext conversion to ciphertext via encryption keyplatform intermediate

API beginner

How APIs enable communication between different software systems

How APIs enable communication between different software systems