Google Releases New Gemini 2.0 Models, Expands AI Capabilities for Developers and Users - Related to revenue, growth, expands, dutch, genai

Dutch startups raised $3.5B in 2024. Here are the 10 largest funding rounds

It’s been a great year for the Dutch startup ecosystem.

Venture capitalists have, so far, invested $[website] into Netherlands-based early-stage companies, . That makes 2024 Dutch tech’s second-best funding year ever, surpassed only by 2021.

Dutch startups have raised almost 50% more ($[website] cash this year than in 2023 — and there are still two weeks to go. It’s a striking uptick, especially considering the rather muted funding environment in broader Europe, which is on course for its worst year since 2020.

The Netherlands stands to be Europe’s fourth best-funded ecosystem for 2024. It ranks two places higher than last year, beating out Sweden and Switzerland. Unsurprisingly, the UK will clinch the top spot, with $17bn raised so far. Germany is second at $[website], while France is coming in at a close third with $[website].

So, with that in mind, here are the 10 largest funding rounds that made 2024 such a lucrative year for the Dutch startup ecosystem. (Disclaimer: For this list, we count all early-stage companies headquartered in the Netherlands, not necessarily founded there).

This was a whopper. The startup, which builds full-stack AI infrastructure for tech firms, secured the equity in December in a deal led by Nvidia, Accel, and other blue-chip investors.

*(While Dealroom counts Nebius as a startup, they’re a public corporation so we’re not so sure.).

The Dutch online supermarket unicorn bagged the funding in January to fuel its international expansion, as it looks to become a profitable grocery delivery service (which has proven bloody difficult for most).

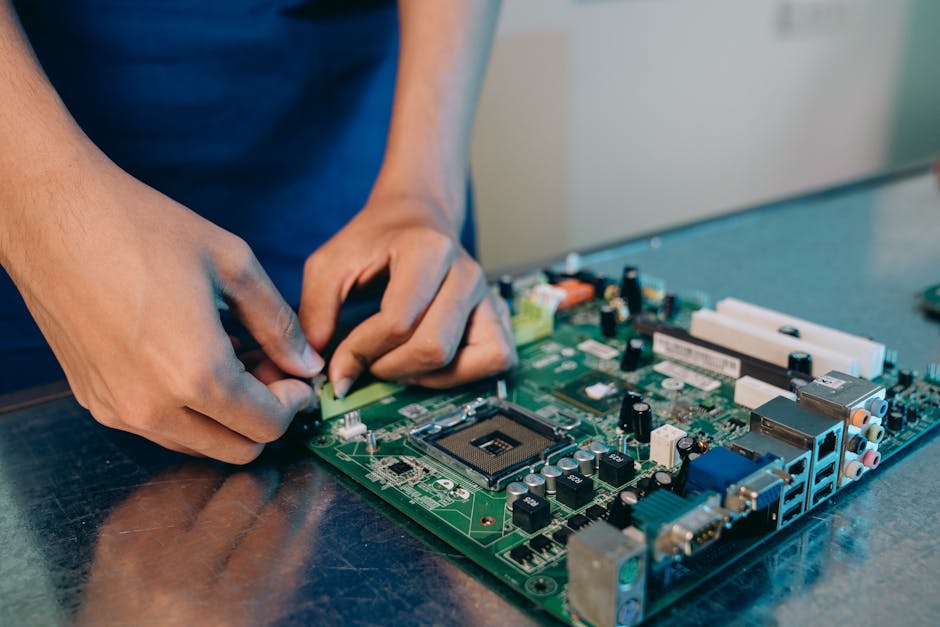

The Rotterdam-based firm makes advanced tools for inspecting computer chips during manufacturing, adding to the Netherlands’ wealth of semiconductor success stories.

Cha-ching! We have a new unicorn in the house. More accurately, in our house, seeing as Mews is based at TNW City in Amsterdam. The startup, which provides a cloud-based property management system (PMS) for the hospitality industry, raised $110mn in March at a valuation of over $[website] Then in September, it bagged another $100mn.

Cha-ching, again! DataSnipper, which makes AI-powered accounting tools, raised $100mn in February at a $1bn valuation making it the Netherlands’ second newly minted unicorn for 2024.

The biotech corporation is developing treatments for inflammatory diseases. It will use the Series B funding to bring its lead product, CIT-013, into Phase 2a clinical trials.

Founded in 2022, Cradle uses generative AI to design and optimise proteins, aiming to reduce the time and cost associated with protein engineering. The Amsterdam-based startup wants to put its software “into the hands of a million scientists.”.

The Eindhoven-based startup is developing chips, known as AI processing units (AIPUs), that enable computer vision and generative AI in devices like robots and drones. The funding round was led by Samsung’s venture arm. For a chip startup, that’s not a bad investor to have onboard.

Payt Software’s AI-powered platform streamlines the debt collection process through automated invoicing. Not exactly ‘sexy’ tech, but the startup’s product is used by over 13,000 businesses in the Netherlands alone so it must be doing something right.

Founded in 2019, Vico is developing therapies for severe neurological diseases. The business is the third health tech startup on this list and for good reason — the Netherlands has established itself as one of the world’s leading hubs for biotech and life sciences.

Overall, the Dutch startup ecosystem has proven its resilience and strength in 2024, achieving remarkable growth despite broader challenges in the European funding environment. Standout performances come from the sectors of biotech, AI, and semiconductors. As we look ahead, these funding successes position the country’s startups for even greater global impact going into 2025.

Le Premier ministre britannique Keir Starmer a pris une décision qui pourrait faire des vagues sur la scène internationale. Il ne participera pas au S...

Google DeepMind spinoff Isomorphic Labs expects testing on its first AI-designed drugs to begin this year, as tech startups race to turn algorithmic m...

Le 10 et 11 février 2025, Paris deviendra le centre névralgique de la gouvernance de l’IA. Le Sommet pour l’Action sur l’IA, organisé par la France et...

Genpact’s GenAI Revenue Surges 12% in Q4 FY24 as AI Adoption Drives Growth

During its Q4 earnings call on Thursday, Genpact, a global leader in business process transformation, presented a 9% year-over-year revenue increase, with its Data-Tech-AI segment achieving a 12% boost.

The firm’s full-year revenue reached $[website] billion, a [website] increase from 2023, and fourth-quarter revenue of $[website] billion. Genpact continues to position itself at the forefront of AI-driven digital transformation.

The enterprise attributed this growth to its strategic investments in GenAI solutions, which help clients transition from AI prototypes to enterprise-scale implementations. It further noted that it secured 101 new clients and 14 major deals.

Genpact is doubling down on AI innovation.

“We now have more than 145 Gen AI solutions in the production environment with clients, either deployed or going live with Gen AI bookings accelerating to $100,000,000 just in Q4,” CEO BK Kalra noted, signalling massive enterprise demand for AI-driven transformation. “Innovation is front and centre at Genpact.”.

CFO Mike Weiner underscored agility as a key focus for 2025, noting, “Speed is a key focus for us in 2025,” highlighting the firm’s push for faster, AI-powered execution.

AI Innovation and Competitive Positioning.

Genpact’s focus on AI is evident in its AI Value Studio and Genpact Gigafactory, both designed to accelerate AI deployment across industries. The AI Value Studio enables businesses to identify high-impact AI use cases and create customised AI roadmaps.

Meanwhile, the Gigafactory helps scale AI solutions for enterprises, ensuring seamless GenAI integration. The organization noted its latest AI tools optimise processes such as time-to-bill, credit-free bill processing, and purchase order management, significantly improving accuracy, efficiency, and vendor/customer experience.

The organization is also deploying AI-powered network operations, covering 120,000 endpoints, implementing zero-touch provisioning, and reducing IT support tickets—showcasing how AI enhances internal efficiency alongside client-facing solutions.

Kalra highlighted this shift, saying, “We see ongoing evidence that GenAI is significantly expanding our total addressable market.” This indicates not only increasing AI adoption but also an opportunity for Genpact to capture new market segments through AI innovation.

, 61% of companies now dedicate up to 10% of their tech budgets to GenAI initiatives, reinforcing the growing business imperative for AI adoption.

Genpact faces challenges in a saturated AI market despite its aggressive AI expansion, where numerous competitors offer AI-powered business solutions. The business addresses this by focusing on domain-specific AI models tailored to the finance, supply chain, healthcare, and customer service industries.

Additionally, Genpact is considering mergers and acquisitions (M&A) to bolster its AI capabilities. With AI now contributing 48% of its total revenue, it is poised to become an industry leader in enterprise AI transformation.

Après l’incident qu’a fait objet DeepSeek la semaine dernière, les chercheurs affirment avoir trouvé un moyen de contourner les mesures de protection ...

For the past few months, Meta has been sending recipes to a Dutch scaleup called VSParticle (VSP). These are not food recipes — they’re AI-generated i...

Here is a common scenario : An A/B test was conducted, where a random sample of units ([website] people) were selected for a cam...

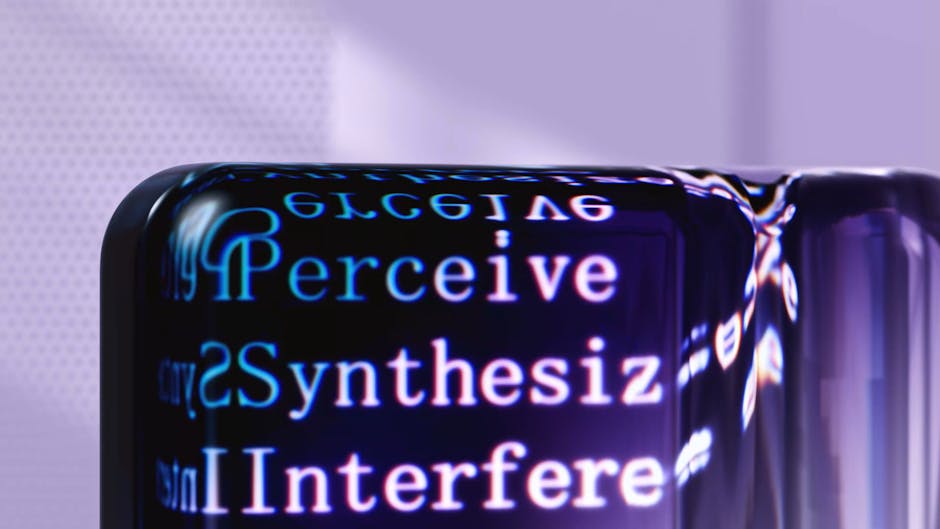

Google Releases New Gemini 2.0 Models, Expands AI Capabilities for Developers and Users

Google DeepMind has made available Gemini [website] Flash and introduced new models, including Gemini [website] Pro Experimental and Gemini [website] Flash-Lite. These updates improve performance, cost efficiency, and versatility for developers and individuals.

Gemini [website] Flash, first introduced at I/O 2024, is now widely accessible via the Gemini API in Google AI Studio and Vertex AI. The model, known for its 1 million token context window, is optimised for high-volume tasks and multimodal reasoning.

“We’ve been thrilled to see its reception by the developer community,” stated Koray Kavukcuoglu, CTO of Google DeepMind. The upgrade also brings improved benchmarks, with image generation and text-to-speech capabilities expected soon.

Alongside Gemini [website] Flash, Google has launched Gemini [website] Pro Experimental, designed for coding performance and complex prompts. This model functions a 2 million token context window, the largest in the Gemini lineup, and supports tools like Google Search and code execution. “It has the strongest coding performance and ability to handle complex prompts,” Kavukcuoglu stated.

The experimental version is available in Google AI Studio, Vertex AI, and the Gemini app for advanced individuals.

For cost-sensitive applications, Google introduced Gemini [website] Flash-Lite, a more efficient model that outperforms its predecessor, [website] Flash, on most benchmarks.

Priced competitively, it can generate captions for 40,000 photos at a cost of less than $1 in Google AI Studio’s paid tier.

Google emphasised its commitment to safety, using reinforcement learning techniques and automated red teaming to address risks, including indirect prompt injection attacks. “We’ll continue to invest in robust measures that enable safe and secure use,” Kavukcuoglu stated.

The [website] Flash Thinking Experimental model will also be available to Gemini app people, accessible via the model dropdown on both desktop and mobile devices.

Pricing details and further information are available on the Google for Developers blog. In the coming months, the organization plans to expand multimodal capabilities and improve the Gemini [website] family.

Google in recent times updated its AI principles, removing explicit bans on using AI for weapons and surveillance. This change departs from its previous stance, which explicitly prohibited such uses since 2018.

The updated policy now focuses on risk-benefit analysis, stating that AI development will proceed where “the overall likely benefits substantially exceed the foreseeable risks and downsides.”.

Differential privacy (DP) is a property of randomized mechanisms that limit the influence of any individual user’s information while processing and an...

The constantly changing nature of the world around us poses a significant challenge for the development of AI models. Often, models are trained on lon...

The Union Budget 2025 unveiled several promising provisions for India’s population of [website] billion people, including the tech and startup community. An...

Market Impact Analysis

Market Growth Trend

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| 23.1% | 27.8% | 29.2% | 32.4% | 34.2% | 35.2% | 35.6% |

Quarterly Growth Rate

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|---|

| 32.5% | 34.8% | 36.2% | 35.6% |

Market Segments and Growth Drivers

| Segment | Market Share | Growth Rate |

|---|---|---|

| Machine Learning | 29% | 38.4% |

| Computer Vision | 18% | 35.7% |

| Natural Language Processing | 24% | 41.5% |

| Robotics | 15% | 22.3% |

| Other AI Technologies | 14% | 31.8% |

Technology Maturity Curve

Different technologies within the ecosystem are at varying stages of maturity:

Competitive Landscape Analysis

| Company | Market Share |

|---|---|

| Google AI | 18.3% |

| Microsoft AI | 15.7% |

| IBM Watson | 11.2% |

| Amazon AI | 9.8% |

| OpenAI | 8.4% |

Future Outlook and Predictions

The Dutch Startups Raised landscape is evolving rapidly, driven by technological advancements, changing threat vectors, and shifting business requirements. Based on current trends and expert analyses, we can anticipate several significant developments across different time horizons:

Year-by-Year Technology Evolution

Based on current trajectory and expert analyses, we can project the following development timeline:

Technology Maturity Curve

Different technologies within the ecosystem are at varying stages of maturity, influencing adoption timelines and investment priorities:

Innovation Trigger

- Generative AI for specialized domains

- Blockchain for supply chain verification

Peak of Inflated Expectations

- Digital twins for business processes

- Quantum-resistant cryptography

Trough of Disillusionment

- Consumer AR/VR applications

- General-purpose blockchain

Slope of Enlightenment

- AI-driven analytics

- Edge computing

Plateau of Productivity

- Cloud infrastructure

- Mobile applications

Technology Evolution Timeline

- Improved generative models

- specialized AI applications

- AI-human collaboration systems

- multimodal AI platforms

- General AI capabilities

- AI-driven scientific breakthroughs

Expert Perspectives

Leading experts in the ai tech sector provide diverse perspectives on how the landscape will evolve over the coming years:

"The next frontier is AI systems that can reason across modalities and domains with minimal human guidance."

— AI Researcher

"Organizations that develop effective AI governance frameworks will gain competitive advantage."

— Industry Analyst

"The AI talent gap remains a critical barrier to implementation for most enterprises."

— Chief AI Officer

Areas of Expert Consensus

- Acceleration of Innovation: The pace of technological evolution will continue to increase

- Practical Integration: Focus will shift from proof-of-concept to operational deployment

- Human-Technology Partnership: Most effective implementations will optimize human-machine collaboration

- Regulatory Influence: Regulatory frameworks will increasingly shape technology development

Short-Term Outlook (1-2 Years)

In the immediate future, organizations will focus on implementing and optimizing currently available technologies to address pressing ai tech challenges:

- Improved generative models

- specialized AI applications

- enhanced AI ethics frameworks

These developments will be characterized by incremental improvements to existing frameworks rather than revolutionary changes, with emphasis on practical deployment and measurable outcomes.

Mid-Term Outlook (3-5 Years)

As technologies mature and organizations adapt, more substantial transformations will emerge in how security is approached and implemented:

- AI-human collaboration systems

- multimodal AI platforms

- democratized AI development

This period will see significant changes in security architecture and operational models, with increasing automation and integration between previously siloed security functions. Organizations will shift from reactive to proactive security postures.

Long-Term Outlook (5+ Years)

Looking further ahead, more fundamental shifts will reshape how cybersecurity is conceptualized and implemented across digital ecosystems:

- General AI capabilities

- AI-driven scientific breakthroughs

- new computing paradigms

These long-term developments will likely require significant technical breakthroughs, new regulatory frameworks, and evolution in how organizations approach security as a fundamental business function rather than a technical discipline.

Key Risk Factors and Uncertainties

Several critical factors could significantly impact the trajectory of ai tech evolution:

Organizations should monitor these factors closely and develop contingency strategies to mitigate potential negative impacts on technology implementation timelines.

Alternative Future Scenarios

The evolution of technology can follow different paths depending on various factors including regulatory developments, investment trends, technological breakthroughs, and market adoption. We analyze three potential scenarios:

Optimistic Scenario

Responsible AI driving innovation while minimizing societal disruption

Key Drivers: Supportive regulatory environment, significant research breakthroughs, strong market incentives, and rapid user adoption.

Probability: 25-30%

Base Case Scenario

Incremental adoption with mixed societal impacts and ongoing ethical challenges

Key Drivers: Balanced regulatory approach, steady technological progress, and selective implementation based on clear ROI.

Probability: 50-60%

Conservative Scenario

Technical and ethical barriers creating significant implementation challenges

Key Drivers: Restrictive regulations, technical limitations, implementation challenges, and risk-averse organizational cultures.

Probability: 15-20%

Scenario Comparison Matrix

| Factor | Optimistic | Base Case | Conservative |

|---|---|---|---|

| Implementation Timeline | Accelerated | Steady | Delayed |

| Market Adoption | Widespread | Selective | Limited |

| Technology Evolution | Rapid | Progressive | Incremental |

| Regulatory Environment | Supportive | Balanced | Restrictive |

| Business Impact | Transformative | Significant | Modest |

Transformational Impact

Redefinition of knowledge work, automation of creative processes. This evolution will necessitate significant changes in organizational structures, talent development, and strategic planning processes.

The convergence of multiple technological trends—including artificial intelligence, quantum computing, and ubiquitous connectivity—will create both unprecedented security challenges and innovative defensive capabilities.

Implementation Challenges

Ethical concerns, computing resource limitations, talent shortages. Organizations will need to develop comprehensive change management strategies to successfully navigate these transitions.

Regulatory uncertainty, particularly around emerging technologies like AI in security applications, will require flexible security architectures that can adapt to evolving compliance requirements.

Key Innovations to Watch

Multimodal learning, resource-efficient AI, transparent decision systems. Organizations should monitor these developments closely to maintain competitive advantages and effective security postures.

Strategic investments in research partnerships, technology pilots, and talent development will position forward-thinking organizations to leverage these innovations early in their development cycle.

Technical Glossary

Key technical terms and definitions to help understand the technologies discussed in this article.

Understanding the following technical concepts is essential for grasping the full implications of the security threats and defensive measures discussed in this article. These definitions provide context for both technical and non-technical readers.

platform intermediate

generative AI intermediate

algorithm intermediate

API beginner

How APIs enable communication between different software systems

How APIs enable communication between different software systems